A case study- understanding risk

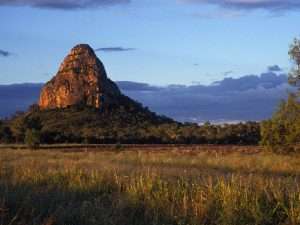

Would you choose to buy in Moranbah or in Toowoomba? Right now it appears a fairly easy choice between the two Queensland centres, but 10 years ago it was a very different scenario. The central Queensland mining town of Moranbah remains our greatest example of a boom-bust scenario. Until 2012, it was the national leader for long-term price growth, having averaged 30% a year over 10 years. Its median price reached $750,000 and tenants were typically paying $1,800 per week. At the same time, the regional city of Toowoomba was a very moderate performer. In 2012 house prices were in decline in the Toowoomba market and growth averages over the previous five years were low, around 3% per year for many suburbs. Toowoomba house rents were generally in the range from $250 to $290 per week, and rental yields around 5.5%. It was a solid market but not a particularly compelling one.The choice then appeared quite straightforward and investors piled into the Moranbah market, seeking those high rental returns and hoping for a continuation of the price growth of the previous 5-10 years.

Moranbah became a victim of its own success

Then Moranbah became a victim of its own success. Key miner BMA refused to pay those rents and moved to 100% FIFO workforces and workers camps. Projects were deferred or downsized in response to falling coal prices. Vacancies rose sharply in 2013, reaching 10%. (More recently they have reduced and reached a benchmark figure of 3% in September 2017, dropped to 1.2% in August 2018 and were 2.3% in June 2021.) Prices also dropped sharply, with an average decrease of 28% per year from 2014 to 2017.The median price started to bounce back from its basement of $150,000 in early 2017 and had reached $280,000 by June 2021 – however this is still lower than prices 10 years ago and well below the peak of $750,000. So the Moranbah market, once the darling of investors across Australia, dropped to very low levels, causing many mortgagee-in-possession sales. Meanwhile, the Toowoomba market rose strongly. In

the five years to the end of 2015, many Toowoomba suburbs recorded growth averaging 10% per year.

Toowoomba continues to be a solid market which experiences periods of strong growth

Toowoomba, a substantial regional city with a strong and diverse economy boosted by major spending on

infrastructure, continues to be a solid market which experiences periods of strong growth – and seldom

records price decline. In 2021 it entered a period of significant new upliftwith several suburbs recording double-digit price growth, boosted by new transport infrastructure. Whether you would have chosen in 2012 to buy in Toowoomba or in locations like Moranbah would have depended on how you perceived risk. Those who do not like high risk should not buy in mining towns or regional centres that are largely dependent on the resources sector. Investors of that kind are better off focusing on locations with lower levels of risk – often relating to economic diversity and lack of reliance on any one sector for prosperity.

One technique for rating yourself

A person’s Risk Profile depends on a number of factors, including …

- Age (a young adult might be willing to take more risks than someone nearing retirement)

- Family situation (single people may be lessconcerned about risk than people with kids)

- Investment experience (those with more knowledge/ experience can handle higher risk)

- Investment goals (e.g. capital growth or income returns)

- Time frame for achieving investment goals (not necessarily dictated by age)

Here’s our adaptation of a Risk Profile rating system for property investors:

PROFILE RATING DESCRIPTION

Defensive You are prepared to accept lower returns with lower levels of risk in order to

preserve capital. Investments are obtained to achieve modest capital growth

over a medium-to-long-term investment horizon.

Conservative You want to protect your wealth and are prepared to accept only a low level of

risk. You invest to achieve moderate capital growth over a medium-to-long-term

investment horizon. You may be inclined to focus on capital city suburbs with

solid track records on capital growth.

Moderate You want to invest in a balance of good income and capital growth. Investments

are obtained to achieve steady growth over a medium-term investment horizon.

Strong regional centres may suit you.

Growth You are comfortable with moderate risk and higher volatility in the value of

investments to achieve higher growth. Investments are obtained to achieve

steady capital growth over a long-term investment horizon. Regional centres that

benefit from the resources sector are an option when it’s rising, but introduce

an element of risk.

Aggressive You are comfortable with a higher level of risk in order to achieve potentially high

returns. Investments are obtained to achieve high capital growth, sometimes

with a short-term view. You are more willing to buy in high-risk high-return

locations such as mining towns and speculative markets like the Gold Coast

high-rise sector, or undertake development.

A Rating Tool for Locations

In terms of choosing a location for property investment, this is how we would classify the various types of

locations in terms of their risk. Keep in mind that this is very general in nature and the classifications do not

apply universally.

The scale runs from 1 to 5, with 1 being lowest risk and 5 being highest risk. This is a very general overview

and specific locations may not always fit the general category

Risk rating 1

•Outer suburbs of capital cities with identifiable growth factors and a good track record

• Middle-ring suburbs of capital cities with identifiable growth factors and a good track record

• Major regional centres with diverse economies, growing populations and clear growth factors.

Risk rating 2

• Minor regional centres with diverse economies and identifiable growth factors

• Inner-city suburbs

Risk rating 3

• Master-planned communities

• Suburbs which lack identifiable growth factors.

Risk rating 4

• Country towns with short-term boosts from major industrial projects

• Sea Change locations where the economy is based on tourism and retirement

• Regional centres with some reliance of the resources sector

Risk rating 5

• City suburbs with major impediments (e.g. noxious industry or waste dumps)

• Mining towns

• Towns affected by long-term drought

Quote Of The Week“It’s still a hot market. The boom isn’t over. Even in Melbourne and Sydney, where it’s slowed, you’re still seeing values rise 1% in a month. Even though the market has slowed in those cities, the rate is still well above average.”

CoreLogic research director Tim Lawless

Thinking of buying an investment property? Book a free consultation with a Reventon property advisor today!

Talk to the Reventon team and we’ll give you all the guidance you need to be a successful at investing your money.